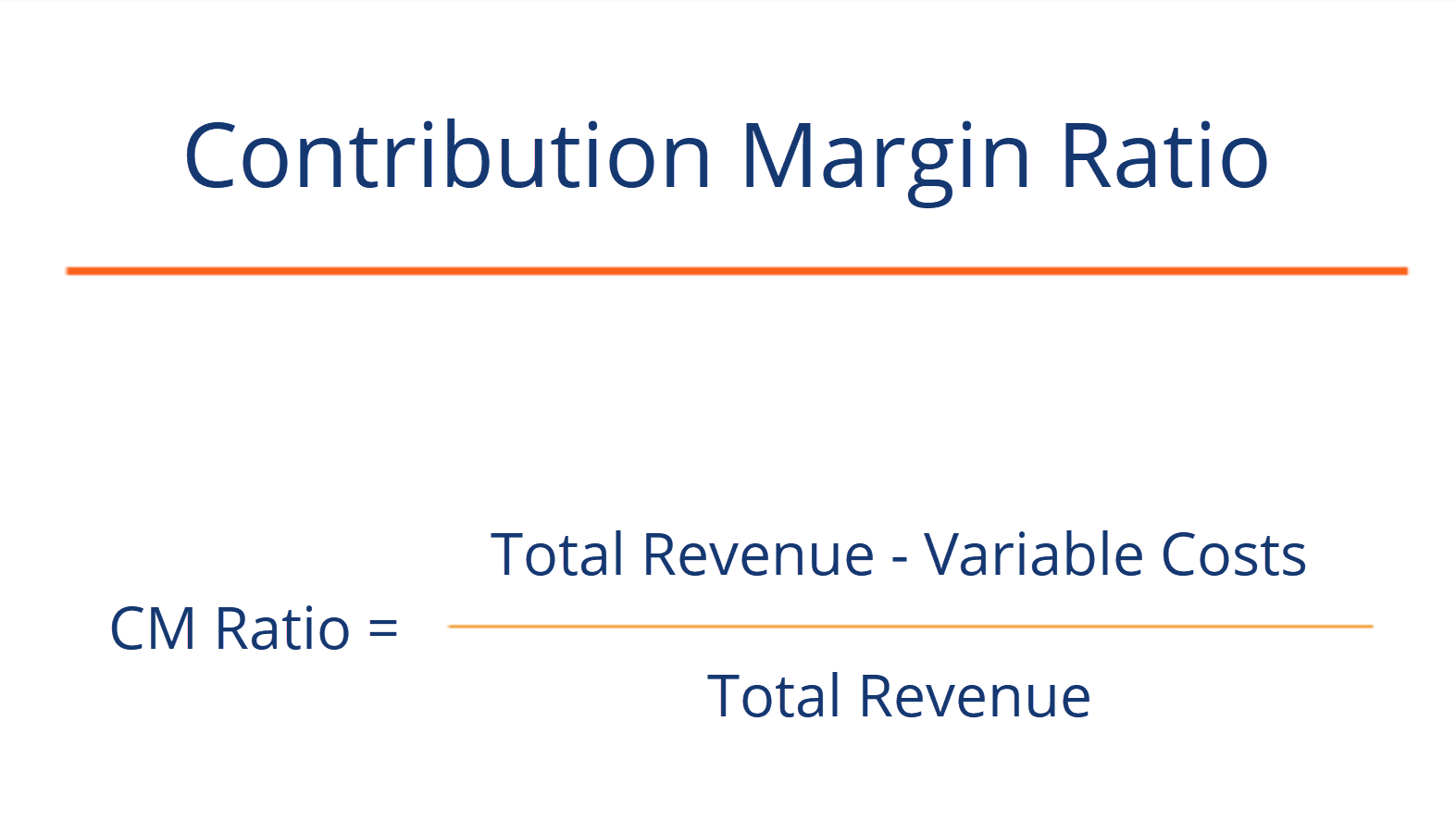

Whether you sell millions of your products or 10s of your products, these expenses remain the same. You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. A firm’s ability to make profits is also revealed by the P/V ratio. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm with a low ratio. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product.

Do you already work with a financial advisor?

To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail. Contribution margin, gross margin, and profit are different profitability measures of revenues over costs. Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs. Profit is gross margin minus the remaining expenses, aka net income. The overall contribution margin is computed using total sales and service revenue minus total variable costs.

Everything You Need To Master Financial Modeling

You work it out by dividing your contribution margin by the number of hours worked. The following frequently asked questions (FAQs) and answers relate to contribution margin. In Cost-Volume-Profit Analysis, where it simplifies calculation of net income and, especially, break-even analysis. Accordingly, the net sales of Dobson Books Company how sales commissions are reported in the income statement during the previous year was $200,000. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Contribution Margin Ratio FAQs

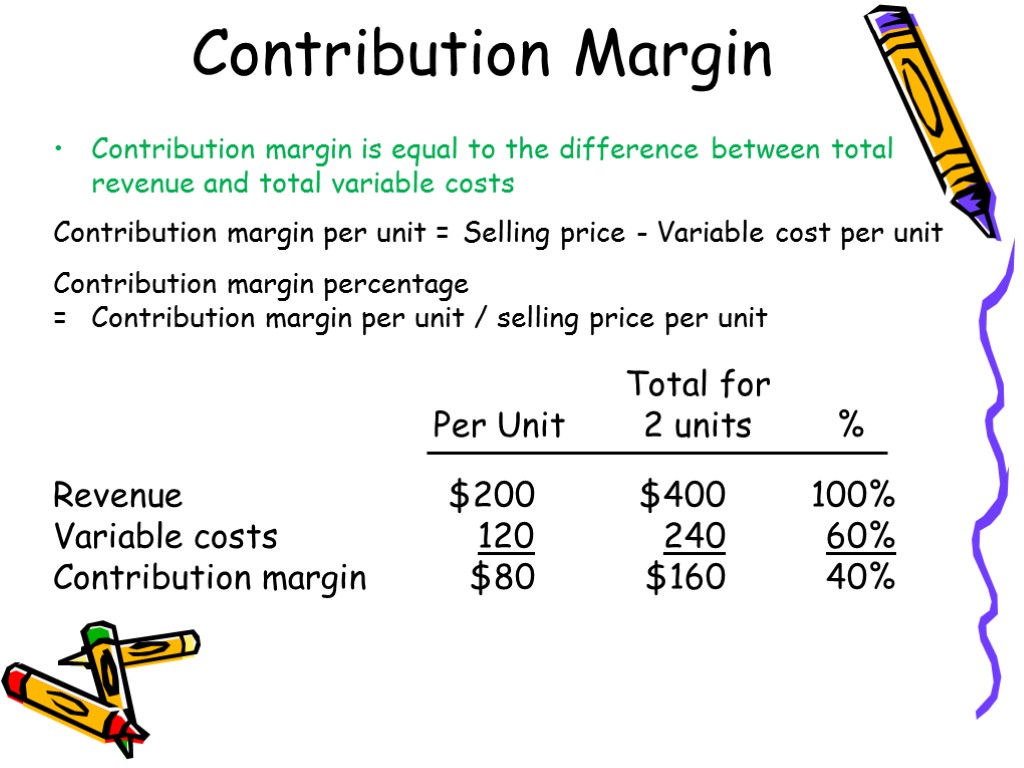

When comparing the two statements, take note of what changed and what remained the same from April to May. When the contribution margin is calculated on a per unit basis, it is referred to as the contribution margin per unit or unit contribution margin. You can find the contribution margin per unit using the equation shown below.

- A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc.

- In May, 750 of the Blue Jay models were sold as shown on the contribution margin income statement.

- In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line.

- As of Year 0, the first year of our projections, our hypothetical company has the following financials.

For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00. Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section.

A low contribution margin or average contribution margin may get your company to break even. The following formula shows how to calculate contribution margin ratio. The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues. For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it.

The business can also use its contribution margin analysis to set sales commissions. Assume that League Recreation, Inc, a sports equipment manufacturing company, has total annual sales and service revenue of $2,680,000 for all of its sports products. Once you have calculated the total variable cost, the next step is to calculate the contribution margin.

The contribution margin may also be expressed as fixed costs plus the amount of profit. The contribution margin (CM) is the amount of revenue in excess of variable costs. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. You pay fixed expenses regardless of how much you produce or sell. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs.