A break even point could be an ongoing target, say 20 units per week. This provides motivation to work toward your goals and forms a Key Performance Indicator (KPI) that your sales and operations teams can use as a tangible benchmark for success. In conclusion, just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even come out to 5k. In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. “When will we actually make money?” is the burning question for new businesses.

What is a typical time frame to reach the break-even point for a mobile app?

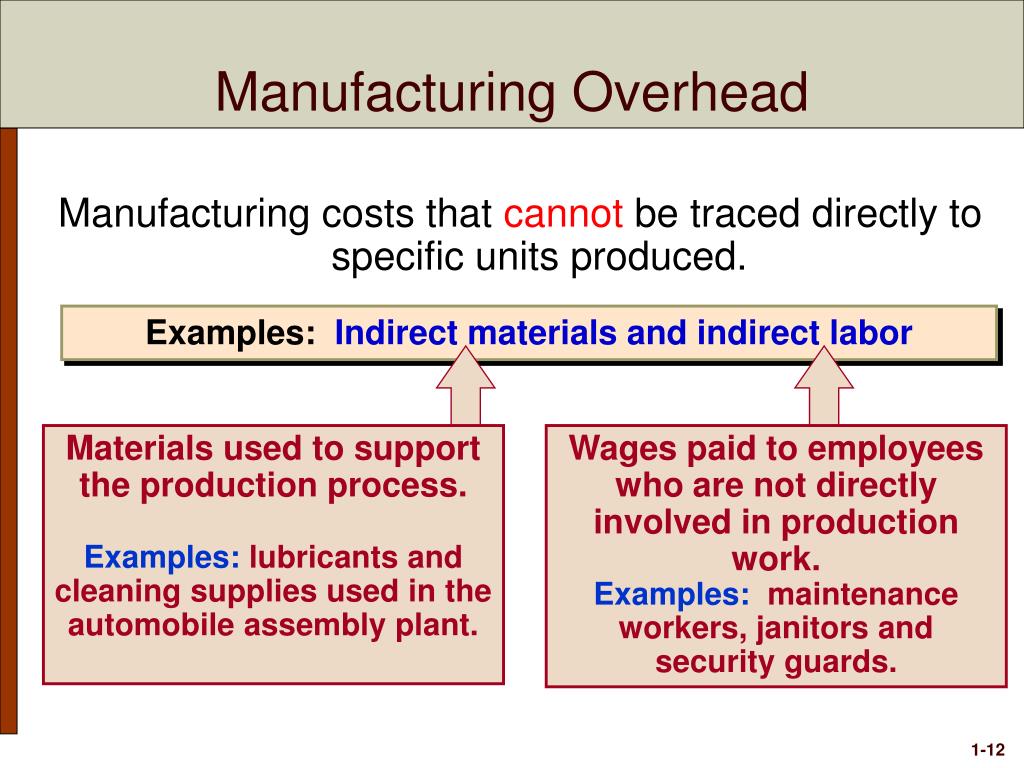

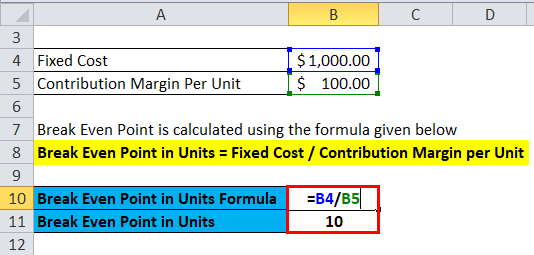

These costs will stay the same regardless of whether you sell one unit or a million units. The denominator of the equation, price minus variable costs, is called the contribution margin. After unit variable costs are deducted from the price, whatever is left—the contribution margin—is available to pay the company’s fixed costs.

How much will you need each month during retirement?

Variable costs often fluctuate, and are typically a company’s largest expense. Calculating the break-even point is a financial analysis for businesses that gives you insight on where your company stands financially. Keep reading to learn everything about this calculation and why it matters, and get the break-even formula. It’s important to study the feasibility of any project or new product line that you’re planning to launch. With break-even analysis, you can identify the time and price at which your business will turn profitable.

Kesalahan Umum dalam Menghitung BEP dan Cara Menghindarinya

It might be a good idea to come back to this break-even calculator after you actually start doing business. Often times you will find the need to adjust your costs and factor in things you overlooked before. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even. Maggie also pays $800 a month on rent, $200 in utilities, and collects a monthly salary of $1,500. You can use the break-even point to find the number of sales you need to make to completely cover your expenses and start making profit.

This will give us the total dollar amount in sales that will we need to achieve in order to have zero loss and zero profit. Now we can take this concept a step further and compute the total number of units that need to be sold in order to achieve a certain level profitability with out break-even calculator. Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag.

Additional Business Services

You might wonder, “What is a good BEP?” The answer largely depends on your industry, cost structure, and business model. A “good” break-even point allows you to cover your costs quickly and start generating profit. Performing a regular break-even analysis is essential for maintaining financial health, especially in periods of growth or economic uncertainty. This formula calculates the number of units you need to sell to break even. In this article, we’ll break down the break-even point formula, how to calculate it, the importance of its analysis, and more. We will also explore how to effectively use Excel for your calculations, making financial forecasting simpler and more accurate.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Input your data and get instant results for informed financial decision-making. This means you need to sell 3,333 cups of coffee per month to break even. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function.

By conducting a thorough break-even analysis, you can enhance your business’s financial stability and long-term success. In addition, break-even analysis helps make decisions about scaling production. If a business is considering expanding, break-even analysis provides insights into how much additional production is needed to make the investment worthwhile. It can also help in evaluating the impact of changes in costs, prices, or sales volume. As you can see, the Barbara’s factory will have to sell at least 2,500 units in order to cover it’s fixed and variable costs.

- Another critical factor is limiting constraints such as capacity and market demand.

- Fixed costs include expenses that do not change with the number of downloads, such as development, marketing, and server maintenance fees.

- Our business plan for a mobile app will help you succeed in your project.

Upon doing so, the number of units sold cell changes to 5,000, and our net profit is equal to zero. By looking at each component individually, you can start to ask yourself critical questions about your pricing and costs. For example, if the economy is in a recession, your sales might drop. If sales drop, then you may risk not selling enough to meet your breakeven point. In the example of XYZ Corporation, you might not sell the 50,000 units necessary to break even. In accounting, the margin of safety is the difference between actual sales and break-even sales.

Break-even sales are the dollar amount of revenue at which a business earns a profit of zero. Selecting the right tool depends on the complexity of the business’s financial model and the need for ongoing updates or detailed analysis. Businesses with more complex financial operations may benefit from using accounting software that integrates break-even how to reconcile supplier invoices analysis into its suite of financial tools. Programs such as QuickBooks, Xero, or FreshBooks offer break-even analysis as part of their reporting functions. Tamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses.

With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta’s writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge. Because those aren’t static analyses, they give business owners more than a snapshot of the present, but also a forecast of the future. If you need a more extensive assessment of your business health, Ryze recommends sensitive analysis and scenario planning as alternatives for the break-even formula. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.